Common Red Flags of Dealer Auto Fraud When Buying a Used Car in California

Buying a used car can be exciting—but it can also be risky if you’re not aware of the common warning signs to watch out for. Unfortunately, some car dealers in California engage in deceptive practices to hide problems like branded titles, hidden damage, or misleading histories. Knowing the warning signs—such as a dealer refusing to show the title or rushing you into signing paperwork—can save you from costly mistakes and legal headaches.

In this guide, we break down the most common red flags of dealer fraud, explain your legal protections under California law, and show you exactly what to do if you suspect you’ve been taken advantage of. Whether you’re shopping for your next car or trying to recover from a bad deal, this information can help you spot the scams and fight back with confidence.

#1 The Dealer Refuses to Provide the Vehicle Title or History Report

One of the most common signs of dealer fraud in California is a refusal to share the vehicle’s title or a complete history report. When you ask to see the title, the dealer might say, “We’ll get that for you after the paperwork,” or “It’s being processed.” Don’t fall for it.

In California, a dealer is legally required to provide the title and any known history before the sale. Titles that are branded—marked as salvage, lemon law buyback, or flood-damaged—must be disclosed. If a dealer won’t show you the title up front, it’s often because the car has something to hide.

Consider a Reddit complaint: “Dealership told me car had a clean title but once I got paperwork back from the DMV, it was a salvaged title”. (Reddit.com, 2022). The dealer said they didn’t know. How could they not know?

Tip: Always request the title and a vehicle history report (Carfax, NMVTIS, or AutoCheck) before signing anything.

#2 You’re Rushed Into Signing Without Time To Review Disclosures

Some dealers use pressure tactics to get you to sign paperwork without giving you time to read. “This deal won’t last,” they might say, or “Another buyer is waiting.” But California law requires that all material disclosures—such as branded titles, prior accidents, and mechanical issues—must be provided in writing before the sale.

A consumer complaint on Reddit highlights this red flag: “Car fax report claimed it had no accidents and so did the dealership. A few days later noticed there appeared to a panel slightly misplaced. We took it to an auto body who said it has 100% been in an accident, the bumper had been entirely replaced, poorly done at that” (Reddit.com, 2024).

Verbal statements are meaningless if they’re not backed up in writing. If you’re being rushed to sign, ask for a copy of all disclosures and take the time to read them.

Tip: Never sign under pressure. If the deal is legitimate, it will still be there tomorrow.

#3 The Price Is Far Below Market Value

While everyone loves a deal, if a car is priced thousands below market value, it’s likely too good to be true. Dealers use this tactic to offload vehicles with serious issues—often without telling you.

Take “West”, who thought they found a good deal online when they saw a car listed below average. After purchase, they started to notice damage such as rust under the seats, warping and odor. Then, taking the car to a local mechanic, he learned it had been declared a total loss due to undisclosed flood damage. The dealer had cleaned it up and rebranded it. (Avvo.com, 2021).

This practice, known as title washing, is illegal and dangerous. Flood-damaged cars often have ongoing electrical issues, mold, and hidden corrosion.

Tip: Always compare prices on Kelley Blue Book and Edmunds. If the car is underpriced, find out why.

#4 The Paperwork Doesn’t Match What You Were Told

Another red flag is when the sales contract or warranty documents contradict what the dealer promised verbally. You might be told the car has a warranty, but the contract says “as is.” Or they may say it has a clean history, but the VIN search shows multiple past accidents.

These bait-and-switch tactics are not just dishonest—they’re illegal. California’s Consumer Legal Remedies Act and The Vehicle Code prohibit misrepresentation in advertising and sales.

A California buyer’s Reddit complaint titled “Texas dealer told us warranty would cover any issues” illustrates this problem: The buyer was verbally assured by the dealer that the vehicle came with a 100-day warranty covering any engine issues. However, when the car’s engine failed a few months later, the warranty provider denied coverage. Further investigation revealed the dealer submitted warranty documents that were different than the ones provided to the buyer. The buyer was left with costly repairs, warranty disputes, and a dealership unwilling to honor their promises (Reddit.com, 2020).

Tip: If the contract doesn’t match the verbal promises, don’t sign. Insist on corrections before purchase.

#5 Signs of Hidden Damage or Unreported Repairs

Fraudulent dealers often sell cars that look good on the outside but have deep, hidden issues underneath. Watch out for:

- Mismatched paint (indicating panel replacements)

- Non-functioning airbags

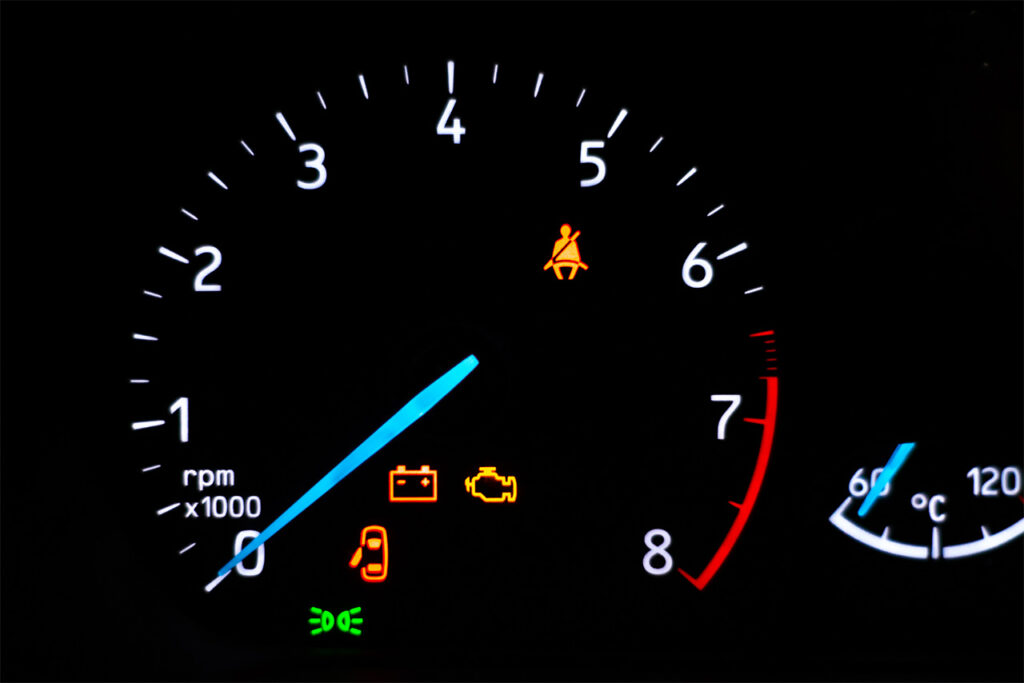

- Check engine lights mysteriously disabled

- New parts in one area of the vehicle only

California law requires dealers to disclose known material facts. Selling a damaged car as clean is fraud.

Tip: Hire an independent mechanic to inspect the car before purchase.

#6 Additional Warning: Unlicensed Dealerships Operating Illegally

Not all vehicle sellers are properly licensed by the California DMV. Some operate as curbstoners—individuals or businesses selling cars illegally without disclosing their dealership status. These sellers often skip inspections, misrepresent mileage, and avoid responsibility when things go wrong.

A report from the City of San Diego warns consumers about ‘curbstones’ operating across California, posing a serious risk to consumers (SanDiego.gov, 2012). They may advertise on social media, online marketplaces, or place handwritten signs on vehicles parked on the street

Tip: Always verify that the seller is a licensed dealer. Use the DMV’s occupational license lookup before doing business.

How California Law Protects Used Car Buyers

California has some of the strongest auto fraud protections in the country. State laws require:

- Dealers to disclose all known material defects

- Written notices for branded title vehicles

- Honest advertising and truthful odometer disclosures

Violations of these laws can lead to civil penalties, rescission of contracts, and damages.

Key statutes include:

- Vehicle Code – Governs dealer honesty and required disclosures

- Consumer Legal Remedies Act – Gives consumers the right to sue for deceptive practices

- Business and Professions Code – Protects against unfair competition and fraud

Tip: If you think your rights were violated, talk to an auto fraud attorney immediately.

What to Do If You’ve Been a Victim of Dealer Fraud

If you’ve discovered after purchase that your car has hidden damage, a branded title, or doesn’t match what was promised, here’s what to do:

- Document Everything – Save all emails, texts, contracts, and receipts.

- Get a Mechanic’s Report – A professional inspection can help identify undisclosed issues.

- Request Your Title – Check if it’s branded or altered.

- Report the Dealer – File a complaint with the California DMV and BBB.

- Consult a Lawyer – A qualified auto fraud attorney can guide you through filing a legal claim.

Tip: Don’t delay—fraud cases have time limits. Contact a legal professional as soon as possible.

We Help Consumers Uncover Dealer Fraud—and Fight Back

At our firm, we help Californians who were misled by dishonest car dealerships. We investigate title history, review documents, and pursue legal action to recover money lost to fraud.

If you were sold a car with a branded title, undisclosed damage, or false advertising, you have rights under California law. We’ve helped clients cancel contracts, recover full refunds, and secure compensation for repairs, lost value, and legal fees.

Don’t let a dealership get away with deception. Contact our office at 800-219-3577 for a free case review.

Final Checklist: How to Spot Dealer Fraud Before You Buy

Before buying a used car in California:

- Ask for the title and history report (Carfax or NMVTIS)

- Look for “branded title” labels (salvage, lemon, etc.)

- Compare the price to Kelley Blue Book

- Take time to review disclosures and the sales contract

- Bring in a mechanic for an independent inspection

If a dealer pushes back on any of these, walk away.

You deserve honesty and transparency when buying a car. If you didn’t get it, we’re here to help.

Conclusion: Stay Smart, Stay Protected

Buying a used car in California doesn’t have to be a gamble. By watching for the red flags of auto dealer fraud—like hidden histories, suspicious pricing, and rushed paperwork—you can make informed decisions and avoid costly mistakes.

If you already purchased a vehicle and suspect you’ve been deceived, don’t wait. Call us today at 800-219-3577. Our firm helps California consumers get justice and expose dealer fraud.

Whether it’s a hidden branded title, bait-and-switch tactics, or outright lies, we’ll help you hold the dealer accountable.

Get a free case review today and find out how we can help you fight back.

California Dealers Selling Branded Title Vehicles Without Telling You? Here’s What You Must Know

“They Never Told Me the Car Had a Branded Title”

A California consumer thought she had found the perfect used SUV at a dealership in Bakersfield. It was a great price, low mileage, and the dealer described it as a “clean car with minor cosmetic repairs.” But after reviewing her car’s documents at home, she saw a phrase she hadn’t noticed before: “Branded Title.” A quick online search confirmed her fear—her new SUV had previously been declared a total loss. The dealer never told her.

If this sounds familiar, you’re not alone. In California, too many consumers are sold cars with branded titles—including salvage, flood, lemon law, or junk history—without full disclosure. These vehicles are legally required to carry written warnings, but some dealers try to hide the facts.

This article explains everything you need to know about branded title vehicles, why they’re risky, how California law protects you, and what you can do if you were sold one without knowing.

What Is a Branded Title Vehicle?

A branded title is a permanent designation on a vehicle’s title that alerts future buyers that the car has experienced significant damage or issues. Common types of title brands in California include:

- Salvage: The vehicle was declared a total loss due to accident, fire, or theft.

- Flood: The car sustained water damage and may have electrical or corrosion problems.

- Lemon Law Buyback: The vehicle was returned under California’s Lemon Law.

- Junk or Dismantled: The vehicle was considered non-repairable and sold for parts.

These brands are intended to provide transparency to consumers. Once a title is branded, the designation stays with the car for life—even if it’s repaired and returned to the road.

How Do Vehicles Get Branded Titles?

Branded titles result from serious incidents in a vehicle’s history. For example:

- If a car is in a severe accident and the insurance company determines the cost to repair exceeds the car’s value, the title is branded as salvage.

- If a car is submerged in floodwaters—common in storms or hurricanes—it may receive a flood title.

- If a car is bought back by a manufacturer under the Lemon Law, the title will be marked lemon law buyback.

In each case, the vehicle has suffered substantial damage, and the brand helps warn future buyers. This process is designed to protect the public—but it only works if dealers comply with disclosure laws.

How the California DMV Treats Branded Title Vehicles

The California DMV strictly regulates branded titles. Once a brand is added, it is permanently displayed on the title and registration. This includes both physical titles and electronic title records. Brands such as “salvage,” “lemon law buyback,” or “flood damage” are not removable.

In addition to title branding, the DMV may require extra inspections for vehicles being re-registered—especially salvage and revived vehicles. For example, a salvage vehicle must pass a revived salvage inspection before it can be issued a new registration.

Despite these requirements, dishonest dealers sometimes fail to show the branded title during the sale or skip disclosure altogether. If a consumer never sees the branded document, they may have no idea what they’re buying.

What Are the Risks of Buying a Branded Title Vehicle?

Branded title vehicles are often sold for less money, but the savings come with serious trade-offs. These cars may have been poorly repaired or had only cosmetic fixes. The risk of future mechanical failure is much higher than with clean-title vehicles.

Here are common problems reported by buyers of branded title cars:

- Electrical issues that cause dashboard malfunctions or lighting failures

- Unreliable engine or transmission performance

- Structural weaknesses from frame damage

- Persistent leaks or mold (especially in flood-damaged cars)

These problems might not show up on a short test drive—but they often appear within weeks of ownership.

Safety Risks of Branded Title Vehicles

Safety should be a top concern. Vehicles involved in major accidents or floods often have compromised airbag systems, damaged crumple zones, or weakened suspension components. In some cases, airbags may not deploy during a crash due to faulty sensors or improper repairs.

Many branded vehicles are repaired on a budget. That means aftermarket parts, patch jobs, and skipped safety checks. Just because a car looks good on the outside doesn’t mean it’s safe.

A branded title is often a red flag that the car’s safety systems may no longer function as designed. That’s why disclosure is not just a legal requirement—it’s a moral one.

Why Branded Title Vehicles Are Often Overpriced

Legally, a branded title car should be valued much lower than its clean-title counterpart—typically 20–50% less. But some dealers ignore this rule. They fix the car cosmetically, clean up the history report, and sell it at or near market price.

Buyers who don’t know what “branded title” means may assume they’re getting a good deal. But once they realize the car’s history—or try to resell it—they find out the truth.

Overpricing a branded vehicle is not only deceptive, it’s financially harmful. If you overpay for a car that should’ve been deeply discounted, you’re entitled to compensation.

Why Branded Title Cars Are Hard to Resell

Branded title vehicles lose value fast and are tough to sell. Many dealerships won’t accept them as trade-ins. Private buyers shy away when they see “salvage” or “lemon law buyback” on a Carfax report. And insurance companies may offer only limited coverage.

Even if your branded title vehicle runs well, the stigma attached to the brand makes it difficult to move. That’s why most experts recommend avoiding branded title cars unless you’re fully informed and paying a deeply discounted price.

What California Law Requires Dealers to Do

California Vehicle Code clearly states that dealers must disclose any branded title in writing to the buyer before the sale. This includes titles branded as:

- Salvage

- Lemon law buyback

- Flood

- Junk

- Any other designation from the DMV

Dealers must present the actual title document or a written disclosure form. Verbal disclosures are not enough. The buyer must be informed before they sign the contract.

Failure to disclose a branded title is considered auto fraud and may result in legal action against the dealer.

What Are Your Rights If You Bought a Branded Title Vehicle Without Knowing?

If a dealer sold you a branded title vehicle without telling you in writing, you may be entitled to:

- Cancel the contract and return the car (rescission)

- Get your money back or receive compensation for lost value

- Recover legal fees if you win your case

- Sue for fraud or deceptive practices under state law

California has strong consumer protection laws that favor buyers in these situations. But timing matters. The sooner you act, the better your chances of getting justice and a fair outcome.

What Laws Protect California Buyers From Undisclosed Branded Titles?

Several California laws are specifically designed to protect consumers from deceptive practices related to branded titles:

- California Vehicle Code prohibits any misrepresentation of a vehicle’s condition or history, including failure to disclose title branding.

- Consumer Legal Remedies Act (CLRA) allows consumers to take legal action against businesses that engage in unfair or deceptive practices.

- California Business and Professions Code defines and prohibits fraudulent, unfair, or unlawful business acts.

These laws are enforceable in court and offer powerful remedies for victims, including the potential for compensation and punitive damages in extreme cases of dealer fraud.

What Legal Remedies Are Available in California?

If a California dealer sells you a branded title vehicle without proper disclosure, you may have the right to:

- Rescind the purchase agreement and return the vehicle

- Get a full refund or financial compensation for reduced value

- Recover damages for repairs, loss of use, or safety concerns

- Receive attorney’s fees and court costs if successful in a lawsuit

In cases of willful fraud, courts may also award punitive damages to punish the dealer and deter future misconduct. Many auto fraud attorneys in California accept these cases on a contingency basis, so you pay nothing unless they win.

Why So Many People Are Searching for Help Online

Search engines are filled with questions like “what is a branded title?” or “can a dealer sell a salvage car?” — this is a sign of how common this issue is. Many buyers don’t even realize their vehicle has a branded title until it’s time to insure it, resell it, or fix major hidden issues.

This trend reveals a systemic problem in the used car industry, where unethical dealerships take advantage of consumers’ trust. By reading articles like this, you’re already taking an important step toward protecting yourself and spreading awareness.

We Help Victims of Branded Title Auto Fraud

At our firm, the Law Office of Paul Mankin, we focus on helping California consumers who have been misled into purchasing vehicles with undisclosed branded titles. We’ve seen the financial and emotional toll this takes. You deserve honesty and fairness when buying a vehicle.

If you’ve experienced this, don’t hesitate to call us at 800-219-3577. We offer a free consultation to evaluate whether you have a case and do not charge upfront attorney fees. Our attorneys work on a contingency basis, meaning you don’t pay unless we win. Our experienced attorneys are committed to holding dishonest dealers accountable and helping you pursue justice.

How to Avoid Branded Title Scams in the Future

Before you buy a used car in California, follow these steps to avoid branded title fraud:

- Always ask to see the title—and check for any brands or labels

- Run a Carfax or AutoCheck report for accident, salvage, and ownership history

- Ask in writing if the car has ever been branded, salvaged, or repurchased

- Inspect the vehicle with a trusted mechanic, especially if it’s priced well below market value

If anything seems off, walk away. The cost of a rushed decision can far outweigh the savings.

Conclusion: You Have Rights—And We Can Help

uying a car should never feel like a trap. If you were sold a branded title vehicle in California and the dealer didn’t tell you in writing, you may be the victim of auto fraud. The law is on your side, and there are legal paths to correct this wrong.

You may be entitled to cancel the deal, get your money back, and hold the dealer accountable. Don’t wait—contact an experienced auto fraud attorney today to protect your rights and secure the compensation you deserve.

California Car Dealers Selling Salvage Title Cars Without Telling You? Know Your Rights Now

“I Didn’t Know It Was Salvage Until It Was Too Late”

“Ashley” was thrilled when she bought her first car from a dealership in Los Angeles. It looked flawless, drove smoothly, and the dealer even praised its “great condition.” But three months later, Ashley discovered the truth: the car had a salvaged title due to a past flood. Her insurance refused full coverage, and mechanics found corroded electronics throughout the engine bay. She had unknowingly bought a vehicle with a dark history—and she had been scammed.

Sadly, Ashley’s story isn’t rare. Every year, thousands of Californians unknowingly purchase salvage vehicles from car dealers who fail to disclose the vehicle’s true condition. In many cases, these cars are sold as if they are problem-free, despite having been through severe accidents, floods, fires, or thefts. Let’s walk through what a salvage title means, the risks it brings, and most importantly, what California law says about a dealer’s duty to disclose.

What Is a Salvage Title Vehicle?

A salvage title is issued when a car has suffered major damage—so much so that an insurance company deems it a total loss. This doesn’t always mean the vehicle can’t be repaired, but it does mean the cost to fix it exceeded its pre-damage value. Once this determination is made, the DMV permanently brands the car’s title as “salvage.”

Salvage-titled vehicles are often repaired and re-sold, sometimes by individuals, but often by used car dealers looking to make a quick profit. The law allows them to sell these vehicles, but they must inform the buyer clearly and in writing before the sale is finalized.

How Cars Become Salvage: Common Scenarios

There are several ways a car can earn a salvage title. Some are dramatic, like a collision that bends the frame or a fire that guts the interior. Others are less visible but equally damaging, like being submerged during a flood or stripped after a theft. In California, natural disasters can also contribute to these designations—think of cars affected by wildfires or mudslides.

Even though these vehicles can be cosmetically repaired and made to look almost new, the underlying damage may persist. And unless the buyer knows what to look for or demands a title check, the true history remains hidden.

How the DMV Brands and Tracks Salvage Titles

Once a car is deemed a total loss, the insurance company is required to report it to the California DMV. The DMV then brands the car’s title as “salvage.” This designation is a permanent part of the vehicle’s history. Even if the car is repaired, it cannot return to a clean title status.

When a salvage vehicle is later repaired and deemed roadworthy, it can be registered again—but only as a “revived salvage” vehicle. This branding is also recorded by third-party services like Carfax, AutoCheck, and the National Motor Vehicle Title Information System (NMVTIS).

Mechanical Risks of Buying a Salvage Title Vehicle

Salvage title cars can come with a host of mechanical issues. Even if the vehicle looks like it’s in good condition, the repairs may have been done poorly, or vital systems may have been ignored altogether. The most common mechanical risks include frame misalignment, suspension issues, damaged wiring, and failing electronics. In some cases, engines and transmissions may be patched together with mismatched parts or temporary fixes.

These vehicles might run well for a short time, but the problems tend to surface quickly, often costing the new owner thousands in unexpected repairs. And in many cases, mechanics are reluctant to work on salvage vehicles due to their unpredictable condition.

The Hidden Safety Dangers of Salvage Vehicles

The most concerning aspect of a salvage car is the safety risk. Key safety features like airbags, seatbelt tensioners, anti-lock braking systems, or electronic stability controls may no longer function properly. In some cases, these systems were never re-installed after the vehicle was repaired. A car might pass a basic inspection but still fail to protect its occupants in a crash.

Dealers who skip disclosures leave buyers unaware of these dangers, putting lives at risk.

Pricing Pitfalls: When Salvage Cars Are Overpriced

A properly priced salvage title vehicle should sell for significantly less than its clean-title equivalent—often 20% to 40% less. However, dishonest dealers sometimes try to hide the salvage status and sell the car at full market value.

This is not just a pricing issue; it’s fraud. If you pay $20,000 for a vehicle that’s really worth $12,000 due to its history, you’ve lost $8,000—and possibly more in future repair and resale losses.

Why Selling a Salvage Car Later Can Be a Nightmare

Salvage vehicles are hard to resell. Many private buyers and even dealerships will avoid purchasing a salvage car due to the risks and stigma. Even if you do find a buyer, expect to take a significant loss. Trade-in values are also much lower.

In short, you’re often stuck with the car or forced to sell it at a steep discount.

California Law: Dealers Must Disclose Salvage Status

Under California Vehicle Code, car dealers are legally obligated to disclose a vehicle’s salvage title in writing prior to the sale. This disclosure must be clear, detailed, and signed by both the dealer and the buyer. The law does not allow verbal explanations or hidden paperwork.

Dealers are also expected to provide a copy of the branded title to the buyer. Failure to follow these requirements can lead to legal consequences.

What Are Your Rights if You Bought a Salvage Car Without Knowing?

If a dealer failed to disclose the salvage status, you may have the right to cancel the contract, receive a refund, or sue for damages. This kind of nondisclosure is a serious violation of consumer protection laws in California, and courts tend to view such cases favorably for the buyer.

You also may be entitled to legal fees, which means the dealer could end up paying your attorney costs if you prevail.

The California Laws That Protect You from Dealer Fraud

Several legal frameworks protect consumers from this type of fraud:

- California Vehicle Code requires written salvage title disclosures.

- California Business and Professions Code prohibits unfair and deceptive business practices.

- Consumer Legal Remedies Act (CLRA) allows consumers to sue for misrepresentations and nondisclosures in transactions.

These laws ensure that you have a path to justice when misled by a car dealership.

Your Remedies: What Can You Do If You Were Misled?

If you bought a salvage title car unknowingly, California law may allow you to:

- Void the sale (rescission)

- Recover financial losses (damages)

- Force the dealer to cover attorney fees

- Possibly pursue punitive damages if the conduct was willful

A knowledgeable auto fraud attorney can help guide you through these options.

How to Check If a Car Has a Salvage Title Before Buying

Don’t rely solely on what the dealer says. Protect yourself with a few proactive steps:

- Run a vehicle history report using services like Carfax or AutoCheck.

- Use the National Motor Vehicle Title Information System (NMVTIS) for a low-cost title check. Visit Www.Vehiclehistory.gov to view the list of approved NMVTIS data providers.

- Ask the DMV directly about a vehicle’s title status.

- Inspect the actual title document—a salvage designation must be printed on it.

Doing your homework before the purchase can prevent heartache later.

How We Help Victims of Salvage Title Fraud

We have helped many consumers who bought a vehicle that “looked perfect.” Oftentimes, the vehicle is discovered to be salvaged after a consumer tries to sell the vehicle, it mechanically fails shortly after purchase, or it’s discovered to have major structural damage during routine maintenance. Ultimately, the dealer had never disclosed the salvage title. At the Law Office of Paul Mankin, we’ve helped consumers recover their full purchase price and additional compensation for expenses. We work on a contingency fee basis, meaning there will be no attorney fees if you don’t win or settle a case.

We fight for people just like you—people who were misled and deserve justice. Call us at 800-219-3577 if you suspect you or someone you know has been a victim of salvage title fraud.

Why This Is a Common Question Online—and What It Tells Us

Search trends show that thousands of Californians search terms like “dealer sold me a salvage title car” or “how to sue a car dealer for fraud.” This shows how common and underreported the issue is. Consumers often feel alone, unsure if what happened to them was even illegal.

Rest assured: it is illegal, and you have rights.

Can I Still Drive or Insure a Salvage Title Vehicle in California?

Yes, but it’s not simple. In California, a salvage vehicle must pass a special inspection before it can be registered for road use. Once it passes, it’s labeled as a “revived salvage” on the title. Many insurance companies won’t offer full coverage or will only provide liability insurance.

That means you’re taking on extra risk—and extra cost.

How to File a DMV Complaint Against a Dealer in California

If you believe a car dealer sold you a salvage vehicle without properly disclosing its title status, you can file a formal complaint with the California Department of Motor Vehicles (DMV). The DMV has a dedicated Investigations Division that looks into reports of auto fraud. You may file your complaint here: https://www.dmv.ca.gov

To file a complaint online, use the link above to complete the DMV’s Consumer Complaint Form. This form asks for your personal information, vehicle details, dealer information, and a description of the problem. You should attach supporting documents like your sales contract, title, Carfax report, and any communication with the dealer.

Once submitted, the DMV may investigate and take action against the dealership, including fines or suspension of their license. While the DMV may not recover your money directly, their findings can strengthen your civil case.

Filing a complaint sends a strong message that unethical dealership behavior won’t be tolerated and helps protect other consumers.

Can I Get My Money Back for a Salvage Car in California?

Yes, if the dealer did not disclose that the vehicle had a salvage title, California law allows you to pursue a refund or cancel the purchase contract. This legal remedy is known as “rescission,” and it’s intended to restore you to the financial position you were in before the fraud occurred.

In many cases, courts recognize that failing to disclose a salvage title is material fraud. The law supports consumers who argue that they would not have bought the vehicle if they had known the truth. In these instances, the court may order the dealership to take back the car and return your money.

You may also recover incidental expenses such as repair bills, towing fees, or rental car costs incurred due to the misrepresented condition of the vehicle. In some cases, dealers are even ordered to pay for your legal representation.

An experienced auto fraud attorney can help you gather evidence, assess the value of your claim, and file the appropriate legal action to demand full restitution.

Conclusion: Don’t Let a Dealer Get Away With This

If you were sold a salvage title car without knowing, you don’t have to live with the consequences. California law gives you tools to fight back. And with the help of an experienced auto fraud attorney, you can protect your finances and hold deceptive dealers accountable. You have the power to fight back — call us today at 800-219-3577 and take the first step toward justice.

California Car Dealers Selling Former Uber, Lyft, or Taxi Cars Without Telling You? Here’s What You Must Know

“They Didn’t Tell Me It Was an Uber Car”

“Marcus” thought he had scored a deal when he bought a clean-looking SUV from a dealer in San Jose. The mileage looked reasonable. The price seemed fair. The salesperson reassured him the car was “lightly driven” by the previous owner. But just a few weeks later, a friend helped him run a full vehicle history report—and the truth hit hard. His “gently used” SUV had racked up over 150,000 miles while serving as a full-time Uber vehicle. It had been on the road daily, transporting passengers non-stop for nearly four years. Marcus felt blindsided. No one at the dealership had mentioned anything about its former life.

This scenario is becoming all too common in California. Cars that have spent years as taxis, Uber rides, Lyft vehicles, or limos are finding their way onto dealership lots—often without proper disclosure. And many consumers, like Marcus, are stuck with overworked, overpriced cars that were never what they seemed. This article explains the risks, your legal rights, and what you can do if you’ve unknowingly purchased one of these commercial vehicles.

What Is a Rideshare or Taxi Vehicle?

In simple terms, a rideshare or taxi vehicle is any car that has been used to transport passengers for pay. This includes traditional taxis, limousines, and vehicles used for services like Uber, Lyft, and even lesser-known platforms like Via or Wingz. While these vehicles can look like any other used car, what sets them apart is how intensively they were used.

The moment a car becomes part of a commercial transportation fleet, it enters a different category of wear, tear, and usage. These cars may drive triple the mileage of a personal vehicle in a single year. They’re subject to constant stop-and-go traffic, heavy braking, frequent passenger entry and exit, and often only receive the bare minimum maintenance required to stay road-legal. California law treats these vehicles differently—and so should you.

How Rideshare and Taxi Vehicles Are Used

Rideshare and taxi vehicles live a very different life compared to privately owned personal cars. While a typical personal car might be driven 12,000 to 15,000 miles per year, a full-time Uber or Lyft vehicle can easily rack up over 50,000 to 70,000 miles annually. These cars are on the road for hours each day, often during peak traffic hours, and they stop and start hundreds of times in a single shift.

Drivers in the gig economy rely on these vehicles to earn income. That means minimal downtime, constant usage, and only essential repairs to keep the car running. Brake pads wear down faster, tires are replaced more frequently, and interiors take a beating from passenger turnover. Food spills, luggage scrapes, and backseat wear are common. Even with regular cleaning, the vehicle ages much faster than a typical privately owned car.

Mechanically, these cars may look fine to the untrained eye. But their transmission, suspension, steering, and electrical systems often suffer from extended strain. And while some drivers perform diligent maintenance, others defer costly repairs just to stay on the road. That’s the reality of the rideshare grind.

How the DMV Brands or Tracks Commercial Use

The California DMV does not automatically brand a vehicle’s title as “commercial” or “rideshare” after it’s been used as an Uber, Lyft, or taxi. Unlike salvage or rebuilt titles, there’s no distinct visual flag on the paper title to alert buyers to the vehicle’s previous commercial life. However, that doesn’t mean the history is invisible.

Dealers and consumers can uncover commercial use through vehicle history reports, such as those from Carfax, AutoCheck, or NMVTIS. These reports may list prior registration types, mileage records, service entries, and commercial fleet designations. Some rideshare companies also provide documentation upon request.

Dealers have a legal and ethical obligation to review these records. If they find that the car was a commercial vehicle—and they don’t disclose it—they’re not just being dishonest. They may be breaking the law. California Vehicle Code and consumer protection statutes require dealers to tell the truth about a car’s known history. Omitting known commercial use is material misrepresentation.

Mechanical Risks of Ex-Taxi or Uber Vehicles

Vehicles used for commercial purposes endure significantly more stress than personal-use cars. Constant driving across varied terrains, frequent braking, and round-the-clock use all contribute to faster wear and tear. The suspension system, in particular, may be worn out from carrying heavy loads and enduring rough city streets. Similarly, the transmission may have experienced thousands of gear shifts more than a typical car.

You also have to worry about deferred maintenance. Many rideshare drivers are independent contractors working with limited budgets. That means oil changes might be delayed, filters ignored, and mechanical issues patched instead of properly repaired. Cosmetic fixes, like replacing seat covers or cleaning carpets, may cover up the deeper mechanical fatigue that makes the vehicle unreliable.

Buying one of these vehicles without knowing its history exposes you to long-term costs. Transmission failure, suspension collapse, or steering issues can surface soon after purchase. If the car was represented as gently used but turns out to be a rideshare workhorse, you’ve been misled—and your safety and finances are on the line.

Safety Risks in Commercial Vehicles

The constant, high-intensity use of rideshare and taxi vehicles doesn’t just wear out the engine and brakes—it can also compromise your safety. Key components such as airbags, seat belts, and crumple zones may have degraded from overuse or may have been replaced with substandard parts after minor accidents. In many cases, these repairs aren’t disclosed to buyers.

Worn-out suspension can make the vehicle unstable, especially at high speeds. Overused brakes may fail when you need them most. Some ex-taxi vehicles may have undergone structural repairs from fender benders, but without proper parts or professional installation. In high-mileage commercial vehicles, even the steering column or fuel lines can pose hazards.

Unfortunately, many of these safety risks are not immediately obvious. A test drive around the block may not reveal the long-term risks you’ll face as an owner. That’s why buying one of these cars without knowing its history is so dangerous—it puts you and your passengers at risk every time you drive.

Overpriced and Over-Market Valuation Problems

A car that has been used as a taxi or rideshare vehicle should never be priced the same as a vehicle driven privately. Unfortunately, some dealers clean up these cars cosmetically, roll back any visible wear, and list them at full market value. That means you could be paying $20,000 for a vehicle worth half that due to hidden wear and reduced lifespan.

Valuation issues go beyond the sticker price. Insurance companies may limit your coverage options or offer less if you file a claim, citing the vehicle’s commercial history. And when you try to sell it, buyers and dealers alike will offer significantly less once they learn about its background.

Not disclosing the commercial use history not only misleads the buyer—it also warps the entire financial transaction. You’re paying too much for too little, and that’s a form of fraud.

Trouble Reselling a Former Taxi or Lyft Vehicle

Even if the car looks good and runs well, its history follows it forever. If you later try to sell or trade in a former rideshare vehicle, you’ll face steep depreciation. Buyers search Carfax or AutoCheck reports. Once they see a commercial use tag or high mileage pattern, many will walk away.

Trade-in offers from dealers will be lower, too—sometimes thousands of dollars less. That’s because dealerships know how hard it is to resell a car with that kind of wear and baggage. In some cases, buyers have had to discount their vehicle by 30% or more just to get it off their hands.

It’s not fair to be put in this position—especially when you were never told the truth to begin with.

California Law: Dealers Must Disclose Prior Commercial Use

Under California law, dealers are required to disclose any known material facts about a vehicle, including whether it was previously used as a taxi, Uber, Lyft, or other commercial rideshare service. This disclosure must be clear, written, and made before the point of sale. Failing to do so can amount to auto fraud, a serious legal violation.

According to the California Vehicle Code, it is unlawful for a dealer to misrepresent the condition or history of a vehicle. That includes failing to disclose a prior commercial use. Additionally, the Consumer Legal Remedies Act (CLRA) and Business and Professions Code give consumers the right to sue for deceptive business practices.

In essence, if a dealer knew—or reasonably should have known—that a vehicle had been used for commercial purposes and failed to tell you, they may be liable for damages. Dealers have access to vehicle history reports and prior title records, so claiming ignorance doesn’t hold up in most cases.

What Are Your Rights if You Bought One Without Knowing?

If you bought a former Uber, Lyft, or taxi vehicle without disclosure, you are not powerless. California gives consumers strong rights in these situations. First, you may be entitled to rescission, which allows you to return the car and get your money back. Second, you may be entitled to monetary damages for the difference in value, repair costs, or diminished resale price.

If the dealer intentionally misled you, you may also recover attorney’s fees and court costs, which makes it easier to pursue a case even if you’re not in a financial position to pay upfront. Many firms, like ours, offer free case reviews and take cases on a contingency basis for this reason.

It’s also important to act quickly. There are time limits (statutes of limitations) for bringing legal claims, so don’t wait too long to take action. An auto fraud attorney can assess your case and help you understand the best course of action.

The Laws That Protect California Car Buyers

California law has some of the strongest consumer protection statutes in the country. These include:

- California Vehicle Code – Prohibits misrepresentation by dealers.

- The Consumer Legal Remedies Act (CLRA) – Allows consumers to sue for unfair business practices.

- Business and Professions Code – Addresses unlawful, unfair, and fraudulent business acts.

These laws are designed to level the playing field. Dealers have more knowledge and power in a transaction—but the law ensures consumers have a right to honesty, fairness, and remedies when wronged.

Legal Remedies Available to You

If you’ve been the victim of undisclosed commercial vehicle fraud, you may be entitled to:

- Full refund or cancellation of the contract (rescission)

- Compensation for repair costs and loss of value

- Legal fees, court costs, and potential punitive damages

The legal system recognizes how damaging this kind of fraud can be, especially when the car becomes unreliable or unsellable. An experienced auto fraud attorney can help you gather documentation, communicate with the dealer, and file a lawsuit if necessary.

We Help Victims of This Type of Dealer Fraud

At our firm, the Law Office of Paul Mankin, we help Californians who unknowingly purchased former Uber or Lyft vehicles without proper disclosure. A common occurrence is when a consumer thought they bought a well-maintained sedan, only to find out it had been logged in over 1,000 rideshare trips. In this type of situation, the consumer should have a good case and is likely to receive a full refund and legal costs.

We understand how frustrating and financially draining these situations can be. That’s why we fight aggressively to hold dishonest dealers accountable. If this happened to you, we’re ready to help! Don’t hesitate to contact The Law Office of Paul Mankin, APC at (800) 219-3577.

Why This Is a Common Question Online

Thousands of Californians search for help each year after buying a used car that turns out to have a hidden history. Questions like “how to tell if my car was an Uber” or “can a dealer sell an ex-taxi without telling me?” flood search engines. That’s because this practice is alarmingly common, and most people don’t know it’s illegal.

This article exists to help bridge that knowledge gap. You’re not alone—and if this happened to you, there’s a path to justice.

How to Check If a Car Was a Former Rideshare Vehicle

Before buying any used vehicle, always run a Carfax or AutoCheck report. Look for telltale signs like high mileage for the year, frequent service entries, or past registration as a commercial vehicle. Ask the dealer directly and insist on a written statement confirming the car’s history.

You can also check with the National Motor Vehicle Title Information System (NMVTIS), which includes salvage, title, and insurance loss records. Some Uber and Lyft drivers also register their vehicles through fleet management services, which may show up on history reports.

Being proactive can save you thousands—and protect your safety and peace of mind.

Conclusion: Know Before You Buy—Or Fight Back If You Didn’t

If a California car dealer sold you a vehicle that was previously used as a taxi, Uber, or Lyft without telling you, you have rights. The law is on your side, and remedies are available. Whether you’re trying to undo the purchase, recover financial losses, or hold the dealer accountable, don’t face this alone.

Reach out to a trusted auto fraud attorney and take the first step toward justice. Engaging a consumer protection lawyer not only increases the chances of success, offering peace of mind and confidence in the legal process. You deserve transparency—and you deserve a vehicle that matches what you were promised.

California Dealers Selling Lemon Law Buybacks Without Telling You? Here’s What You Need to Know

“They Didn’t Tell Me It Was a Lemon Buyback”

“Kelly” was excited about his new-to-her sedan from a dealer in Fresno. The car looked clean, drove well, and had low mileage. But after a few odd noises and a visit to a mechanic, she discovered the car was a lemon law buyback – previously returned to the manufacturer due to major repeated issues. The dealership never told her.

This kind of situation is more common than most Californians think. Vehicles repurchased under California’s Lemon Law or returned under warranty are sometimes reconditioned and resold. And when dealers don’t properly disclose this status, it’s not just shady – it’s illegal.

This article explains what a lemon or warranty return vehicle is, why it matters, how to recognize the red flags, and what your rights are under California law.

What Is a Lemon Law Buyback or Warranty Return?

A lemon law buyback refers to a vehicle that was legally repurchased by the manufacturer after repeated attempts to fix a serious defect failed. Under California’s Song-Beverly Consumer Warranty Act, commonly known as the California Lemon Law, if a new vehicle cannot be repaired after a reasonable number of attempts, the automaker must either replace the vehicle or refund the buyer.

In many cases, these vehicles are not destroyed. Instead, they are repaired, relabeled as “lemon law buybacks”, and put back on the market. While it is legal to resell these vehicles, California law requires clear and conspicuous written disclosure before the sale.

Similarly, warranty return vehicles may not meet the strict definition of a lemon under California law but were returned under a manufacturer’s warranty because the buyer experienced serious dissatisfaction with recurring mechanical problems. These vehicles often receive the same treatment as lemon buybacks: minimal repair, rebranding, and resale to unsuspecting buyers.

Both lemon law buybacks and warranty return vehicles are often sold at auctions and acquired by used car dealerships, where they are cosmetically restored and resold. When a dealer fails to inform a consumer of this history, it violates California consumer protection laws and may constitute auto fraud.

How Vehicles Become Lemon Law Buybacks or Warranty Returns

Vehicles become lemon law buybacks when the same problem keeps happening, even after multiple repair attempts under warranty. California law doesn’t require a specific number of repair attempts—it uses a standard of reasonableness. That means if your new car is in and out of the shop for the same issue without permanently fixing it, it may qualify.

Once the manufacturer agrees the car meets lemon criteria, they are legally obligated to repurchase or replace the vehicle. That process creates a lemon law buyback. Sometimes, instead of going through the full lemon law process, consumers agree to a warranty return where the manufacturer takes the car back voluntarily due to known issues. This is common in cases of persistent defects that undermine vehicle safety, reliability, or resale value.

These vehicles don’t get crushed. They often get sent to wholesale auctions, where dealers can purchase them at a discount, perform just enough repairs to get the car looking and running well, and then resell it. Without proper disclosure, the new buyer may never know their vehicle was legally deemed defective.

How the California DMV Treats Lemon Law Vehicles

The California Department of Motor Vehicles requires any vehicle that is a manufacturer buyback under the state’s lemon law to be branded as such on the title. The title will include a stamp that says, “Lemon Law Buyback” clearly indicating its legal status. This branding is also required to appear on the registration card.

Additionally, the DMV mandates that a permanent disclosure must be affixed to the vehicle—a decal on the left door frame—stating that the vehicle was repurchased due to a defect. This warning must also include a summary of the problem that led to the buyback.

This branding is intended to protect buyers and inform them before they make a purchase decision. However, if a dealer “loses” the sticker or fails to show the branded title during the sale, the buyer may never see this warning. That’s why it’s crucial to request and review the vehicle’s title and Carfax before completing any purchase.

Mechanical and Reliability Risks of Buying a Lemon Buyback

A lemon law buyback or warranty return is not just a legal label—it usually means the vehicle has persistent, hard-to-fix issues. Even if the car has been repaired, there’s no guarantee that the problem is truly gone. Often, the original defects resurface after more use.

Common lemon issues include engine failure, transmission problems, electrical malfunctions, air conditioning failure, and more. These issues can make the car unreliable, expensive to maintain, and unsafe to drive. Many consumers report that their buyback vehicles break down shortly after purchase—even though they looked perfect on the lot.

Buying one of these vehicles without knowing the history puts the burden of future repairs squarely on your shoulders. You could end up paying thousands of dollars for issues that were supposed to be “fixed” by the manufacturer.

Safety Dangers in Warranty Return Vehicles

Beyond reliability, there are serious safety implications. If a vehicle was bought back due to defects with brakes, steering, engine stalls, or airbag systems, those problems can lead to accidents. Even if repairs were made, some vehicles are fundamentally flawed and not suitable for resale.

The worst part? Some dealers try to cut costs by skipping full repairs before putting the vehicle back on the market. They may clean up cosmetic issues and patch symptoms without addressing the root mechanical defect. That means buyers are unknowingly putting themselves and their families at risk.

When a dealer hides this history, they’re not just lying—they’re endangering lives.

Overpriced: How Lemon Buybacks Are Misrepresented on the Lot

A lemon law buyback vehicle is supposed to be priced significantly lower than a clean-title car of the same year, make, and model. Why? Because of its history, repair risks, and resale challenges.

However, some unscrupulous dealers don’t disclose the history and sell the car at full market value. That means buyers are overpaying by thousands of dollars—thinking they’re getting a great deal on a “used car in great condition.”

This deceptive practice is one of the most damaging aspects of warranty return fraud. It exploits trust, misrepresents value, and leaves consumers financially exposed.

Why Reselling a Lemon Buyback Vehicle Is So Difficult

When a car has been labeled a lemon law buyback, its value drops dramatically. Most buyers won’t touch a lemon-branded vehicle unless it’s steeply discounted. Dealers are hesitant to take them on trade-ins, and online buyers back away quickly once they see the title history.

Even if the car runs well, its resale stigma is hard to shake. You may end up losing thousands or being stuck with a vehicle that no longer fits your needs. Worse, if you weren’t told about the lemon status in the first place, you could be trying to resell a car with a hidden defect.

California Law: Required Disclosures for Lemon or Warranty Return Vehicles

California law is very clear: any dealer who sells a vehicle that is a lemon law buyback must provide written disclosure prior to the sale. This includes:

- A written statement that the vehicle was a lemon law buyback

- A summary of the defect(s) that led to the buyback

- A clear indication on the vehicle’s title and registration

- A warning label affixed to the door frame

These rules exist under California’s Song-Beverly Consumer Warranty Act and are enforced by the Department of Motor Vehicles. If the dealer failed to give you this information in writing before you signed the contract, you may have been the victim of auto fraud.

Consumer Rights If a Lemon Vehicle Was Sold Without Disclosure

If you purchased a lemon law buyback or warranty return vehicle and the dealer never told you, you have legal rights. You may be entitled to:

- Cancel the purchase contract (rescission)

- Receive a full refund or partial compensation for diminished value

- Sue for damages, including repair costs and legal fees

These cases often involve clear violations of consumer protection laws, and courts tend to rule in favor of the misled buyer. Many consumers successfully recover their money, avoid further repair costs, and even receive compensation for inconvenience and lost time.

Laws That Protect Buyers from This Kind of Fraud

California has some of the strongest consumer protection laws in the country, especially when it comes to auto fraud and deceptive dealership practices. Several key statutes come into play when a dealer fails to disclose a lemon law buyback or warranty return:

- California’s Song-Beverly Consumer Warranty Act (Lemon Law): Requires disclosure of buyback status and provides remedies to consumers.

- California Vehicle Code: Makes it unlawful for a dealer to misrepresent the condition or history of a vehicle.

- California Business and Professions Code (Unfair Competition Law): Prohibits fraudulent, deceptive, and unfair business practices.

- Consumer Legal Remedies Act: Allows consumers to sue for damages when misled about the quality or history of goods, including vehicles.

These laws don’t just offer theoretical protections. They provide real tools for consumers to get justice, recover financial losses, and prevent others from becoming victims of the same scams.

Legal Remedies Available to California Consumers

If you’ve been misled into purchasing a lemon law buyback, you may be able to:

- Rescind the vehicle purchase contract

- Recover the purchase price or the difference in value

- Be reimbursed for out-of-pocket repairs

- Recover attorney’s fees and court costs

- Seek punitive damages if the conduct was intentional and egregious

California’s legal system strongly favors the consumer in these cases, especially when a dealer knowingly concealed a branded vehicle’s history. Many attorneys who specialize in auto fraud will take these cases on a contingency basis, meaning you pay nothing unless they win. Moreover, in many situations the car dealer, finance company or other defendant will have to pay the reasonable attorneys’ fees and costs.

Why This Problem Is Widely Searched and Underreported

Search data shows that thousands of Californians look up terms like “bought a lemon car,” “undisclosed warranty return,” or “how to sue a car dealer for fraud.” This signals a widespread issue that’s affecting people across the state.

Unfortunately, many of these buyers don’t know that they have legal recourse—or they’re too overwhelmed to pursue it. Some don’t even discover the truth about their vehicle until months later. That’s why consumer education is key, and why articles like this help close the knowledge gap.

We Help Victims of Lemon Law Dealer Fraud

Our law firm has helps Californians who unknowingly purchased lemon law buybacks or undisclosed warranty return vehicles. A hypothetical example is, a consumer bought a luxury sedan with less than 30,000 miles—only to discover it had been bought back for persistent electrical issues. We would fight the dealer, attempt to rescind the sale, and help the consumer/client get their money back.

If this has happened to you, you’re not alone—and you don’t have to go through it alone either. We offer free consultations and work on a contingency fee basis.

How to Check If a Car Was a Lemon Law Buyback Before You Buy

Before signing any paperwork, protect yourself by:

- Requesting the vehicle’s title and looking for “Lemon Law Buyback” branding

- Checking the Carfax, AutoCheck, or NMVTIS report

- Asking the dealer directly in writing whether the vehicle was ever repurchased under lemon law or returned under warranty

- Examining the door frame for the required lemon law disclosure decal

If anything seems suspicious—or if the dealer is hesitant to give you this information—walk away. A legitimate dealer should be transparent and cooperative.

Conclusion: You Don’t Have to Accept Dealer Fraud

Being sold a lemon law buyback without proper disclosure isn’t just unfair—it’s illegal. California law gives you the tools to fight back. Whether through rescission, a lawsuit, or compensation, you can take steps to recover what you’ve lost and hold the dealer accountable.

If this happened to you, reach out. We’re here to help you get the justice you deserve. 1-800-219-3577.

California Auto Fraud: Undisclosed Accident History in Used Cars

“This Car’s Never Been in an Accident…”

Imagine being told that your new used car is in “perfect condition”—no accidents, no damage, just a reliable ride. You feel relief, excitement, even pride. But weeks later, during a routine oil change, your mechanic raises an eyebrow: “Did you know this car’s frame was repaired? It looks like it was in a crash.”

The pit in your stomach grows. You call the dealer. They dismiss you. Suddenly, you realize: you were sold a lie. What was supposed to be a trustworthy vehicle is now a dangerous, devalued money pit. And worse, you have no idea what to do next.

And it’s not just you. A consumer in California shared how excited they were to buy a luxury sedan from a local dealership. The salesman promised it had never been in a fender bender. But when they went in for routine service, the technician found that both the hood and front bumper had been replaced with aftermarket parts. A new Carfax, updated after the sale, showed a front-end collision serious enough to deploy the airbags.

Stories of Deception

These aren’t rare stories. In fact, they’re alarmingly common in California. One Reddit user shared how a dealership in San Diego gave them a clean Carfax for a sedan. The salesperson said, Immaculate condition. No accidents. Three months later, paint began bubbling on the passenger door. They noticed the hood didn’t sit flush, and a tire shop flagged frame damage. A follow-up Carfax revealed a collision just weeks before purchase that was reported late (Reddit.com, 2015).

On Avvo, a buyer recounted how a dealer in California assured them of the car’s clean history, showing them a report free of any accidents. But when the car went in for warranty service, the dealership technician mentioned prior repairs to the suspension that were consistent with a significant crash (Avvo.com, 2013). The customer thought they bought peace of mind. Instead, they got a lie on wheels.

One woman recounted on another car forum that her used SUV, purchased from a certified pre-owned dealer, had previously been used as a rental vehicle. Despite the salesperson stating clearly that it had never been in an accident, a different dealership later flagged multiple structural repairs (Community.Cartalk.com, 2017).

Quora discussions are full of similar frustrations. Users ask, How can a car with obvious damage be sold as ‘accident-free’ (Quora.com, 2025). The sad truth is: some dealers count on you not checking twice. And with delayed or incomplete data in vehicle history reports, they often get away with it.

Why Dealers Misrepresent Accident Histories

Dealers know that appearance is everything in the used car market. A car with a clean accident history sells faster and commands a significantly higher price than one with any kind of damage, even cosmetic. This creates a strong incentive to hide the truth or lean on technically true statements like “The report was clean when we sold it.”

Some rely entirely on third-party reports like Carfax or AutoCheck. If an accident isn’t reported to insurance, police, or the DMV, it might never make it onto these reports. Others may know the car’s history but choose to stay quiet, omitting any disclosures while verbally assuring buyers of the car’s condition. In some cases, cars from out of state with “salvage” or “rebuilt” histories are re-titled in California without a trace of their past, a tactic known as title washing.

While not every case involves outright lying, the omission of known facts or reliance on outdated reports can still amount to misrepresentation under California law.

How Buyers Find Out the Truth

The truth often comes out in frustrating, sometimes frightening ways. A mechanic doing a basic tire rotation might notice uneven wear patterns indicating frame misalignment. A body shop could spot non-OEM parts, spray lines, or welds inconsistent with factory work.

Some buyers don’t find out until they try to trade in or sell the car. An appraiser might discover prior damage and offer thousands less than expected. Others pull a fresh Carfax months later and find that an accident was reported after their purchase date—a sign that the damage had occurred but wasn’t yet in the system when they bought the vehicle.

These late discoveries leave consumers angry, disillusioned, and stuck with cars they never would have bought had they known the truth.

Why This Is Dangerous: Safety and Value

It’s not just about being lied to. Vehicles that have sustained serious damage may never be fully safe again, even if they’ve been “repaired.” Structural damage can compromise how a vehicle responds in a collision. Crumple zones may no longer function properly. Airbags might not deploy due to faulty sensors.

And then there’s the financial hit. Once you find out your car has a damaged history, its resale value drops drastically. No dealer wants it on trade-in. Private buyers won’t touch it unless it’s heavily discounted. That means you’re stuck either driving a car you no longer trust or absorbing thousands in losses to get rid of it.

Document’s You’ll Need to Prove Misrepresentation

Documentation is key in these cases. Start by collecting:

- The Carfax, AutoCheck, or other history report provided by the dealer at the time of sale

- The purchase agreement, bill of sale, and any warranty forms

- Disclosure documents, especially those referencing “as-is” conditions or “no prior damage”

- Online listings or advertisements, including screenshots, that mentioned accident-free status

- Emails, texts, or voicemails where the condition was discussed

- Photos of visible damage, uneven paint, or aftermarket parts

- A written inspection or estimate from a mechanic or body shop

You don’t necessarily need all these documents, but these pieces help tell the full story: what you were told, what you believed, and what the dealer should have disclosed but didn’t.

How California Law Protects You

California law offers robust protections for car buyers who have been misled by dealerships about a vehicle’s condition. These laws not only cover direct lies but also omissions and half-truths. Let’s break down the most powerful legal tools available:

1. California Vehicle Code §11713(i): This section explicitly prohibits licensed car dealers from making any untrue or misleading statements related to the sale of a vehicle. That means even if the dealer uses a clean Carfax to suggest the car has never been in an accident—when they knew or should have known otherwise—they may be breaking the law. Misrepresentation doesn’t have to be a bold-faced lie. It includes failing to correct a false impression.

2. California Vehicle Code §11713.1(e): This statute requires that dealers disclose any known damage that materially affects the safety or value of the vehicle. If a dealer knows a car had frame damage, major collision repairs, or airbag replacement, they must disclose it to you. If they don’t, it’s a direct violation of this section, regardless of what the Carfax says.

3. Consumer Legal Remedies Act (Civil Code §1770): The CLRA outlaws deceptive practices in the sale of goods, including automobiles. Misrepresenting the accident history of a car, whether through omission or false statements, gives the buyer the right to rescind the contract, get damages, and recover legal fees. Importantly, this law allows consumers to sue even when the seller didn’t “intend” to deceive—it’s the impact on the buyer that counts.

4. Business and Professions Code §17200 (Unfair Competition Law): This law allows individuals to sue for fraudulent, unfair, or unlawful business practices. It’s often used alongside the CLRA in auto fraud cases. The court can issue injunctions, order restitution, and impose civil penalties on dishonest dealers.

5. Common Law Fraud: California courts recognize fraud as a cause of action when the dealer intentionally misrepresents or conceals facts. This includes telling a buyer “the car’s never been in an accident” when they know otherwise or have reason to suspect it. Successful fraud claims can result in punitive damages on top of your losses, especially if the dealer’s conduct was outrageous or malicious.

If you bring a legal action and succeed, you may be entitled to:

- Full contract rescission – Return the car and get your money back.

- Restitution – Compensation for the loss in value or necessary repairs.

- Attorney’s fees – California law allows prevailing consumers to recover legal costs.

- Punitive damages – In cases of intentional deception.

These laws are designed to ensure consumers are not taken advantage of in one of the most expensive purchases they’ll ever make. But to use these protections, you need solid documentation and a lawyer experienced in California auto fraud cases.

Case Examples: From Clean Title to Total Loss

A consumer purchased a late-model SUV from a dealership that insisted the vehicle had never been in an accident. The dealer showed them a printed Carfax and even highlighted the “No Accidents Reported” line.

Two months later, the family took the car in for routine maintenance, where the mechanic pointed out fresh weld marks on the undercarriage and non-OEM suspension parts. Concerned, they ran another Carfax, which now reflected a front-end collision that occurred just six weeks before their purchase. The vehicle had been totaled in another state, rebuilt, and re-titled in California.

Worse, the airbags installed after the crash were counterfeit. The mechanic confirmed they would not deploy properly in an emergency. This wasn’t just fraud—it was a safety hazard.

This case is a textbook example of how serious these violations can be—and how effective California law is when enforced.

What You Can Do Next

If you suspect your car’s accident history was misrepresented:

- Don’t panic—but act quickly. Start documenting everything. Take detailed photos of damage or unusual repairs. Save text messages, emails, and copies of vehicle history reports.

- Schedule an independent inspection. A reputable body shop or mechanic can provide a detailed report outlining any prior structural damage, frame repairs, or non-OEM parts.

- Get a second Carfax or AutoCheck report. These services update frequently, so what wasn’t on the report the day you bought the vehicle may appear weeks or months later. These changes can make a huge difference in your legal case.

- Avoid confronting the dealership directly. It’s tempting to march into the dealer’s office demanding answers, but it’s often better to speak to a consumer protection attorney first. Anything you say or agree to might be used against you later.\

- Consult an attorney experienced in California auto fraud. Don’t wait. There are time limits to take legal action. Depending on your situation, you may have up to three or four years, but the sooner you act, the stronger your position.

Keeping record of any future expenses, such as repair costs, diminished trade-in offers, or rental fees. These can often be included in a damage claim.

We Handle These Cases Where Dealers Misrepresent the Vehicle’s Accident History

At our firm, these aren’t just cases—they’re personal missions. Every week, we talk to Californians who were misled, mistreated, or outright lied to about the condition of their vehicles. Some paid cash. Others are still making monthly payments on cars that should never have been on the lot.

One client told us that they felt like a fool because they trusted them. That trust is exactly what dishonest dealers exploit—and what we work tirelessly to restore.

We’ve helped clients across California—recover their money, cancel fraudulent deals, and hold dishonest businesses accountable. Our team uses in-depth knowledge of state consumer laws and years of litigation experience to pursue justice, whether through negotiation or the courtroom.

If this has happened to you, you’re not alone. We’re here to help. You have legal rights, and we know how to enforce them. Let us help you take the first step toward turning this frustrating experience into a fair resolution.

Legal Disclaimer: This article is for informational purposes only and does not constitute legal advice. For advice on your specific case, consult a qualified California attorney.

Overcharged Vehicle License Fees in California: What Dealers Don’t Want You to Know

Why did my registration cost so much?

You just bought a car. You’re thrilled — until you look at your contract. Something doesn’t add up. Why did your vehicle license fee seem so high? You do the math and realize you’ve been charged hundreds more than you should have. The excitement of your new purchase starts to fade, replaced by a sinking feeling of being taken advantage of.

This scenario plays out every day across California. Auto dealers add small, hidden overcharges in places most people never think to look, like the Vehicle License Fee. Sometimes it’s only $20, other times it’s $500 or more. While the amounts may vary, the practice is deliberate. Dealers know most buyers won’t notice — or won’t bother to challenge it.

But the truth is clear: this isn’t a harmless mistake. It’s an intentional, illegal way to boost profits.

Customers Ripped Off by ‘Fees’

California consumer bought a certified pre-owned SUV with confidence, thinking the dealership’s reputation meant he was in good hands. During the financing process, he was told, These are standard DMV fees. Everyone pays them. But months later, while researching his annual registration, the client decided to cross-check his original Vehicle License Fee with the DMV calculator. What they found shocked them: they had been overcharged $438.

Another consumer purchased a car for $25,000 and was charged nearly $700 in VLF. But when they later calculated it, they discovered the fee should have been around $162.50. When asking the dealership, they said that’s just what the DMV charges. They made it sound official, like there was nothing the client could do.

Overcharges like these don’t just hurt your wallet — they leave you feeling manipulated and helpless. And with each untold story, dealerships pocket more unearned profits.

What Is the Vehicle License Fee and How It’s Supposed to Work

The Vehicle License Fee (VLF) in California is a state-mandated fee used to fund public services. It’s simple to calculate: it’s 0.65% of the vehicle’s cash purchase price. That’s not an estimate, a suggestion, or a range. It’s a fixed rate, clearly defined by state law.

For example:

- $20,000 car = $130 VLF

- $30,000 car = $195 VLF

- $40,000 car = $260 VLF

The DMV provides a free, online fee calculator for anyone to use. Dealers have access to the same tool and often use it internally. This means they know exactly what the charge should be at the time of sale. There is no excuse for overcharging.

When you buy a car, the dealership is supposed to act as a go-between. They collect the appropriate DMV fees and send them to the state on your behalf. They’re not allowed to mark up those fees or guess the amount. Any overcharge doesn’t go to Sacramento — it goes into the dealer’s pocket.

Why Dealers Overcharge: Small Numbers, Big Profits

To the average car buyer, $40 or $100 might not seem worth pursuing. Dealers know this. They count on consumers to overlook these charges amidst the excitement of a new car and the pile of paperwork.

Now, imagine a dealership sells 150 cars per month and overcharges just $100 on each one. That’s $15,000 a month — or $180,000 a year — of unauthorized profit. That money isn’t earned through service or product — it’s siphoned from customers through inflated government fees.

These fees are usually buried in the fine print, bundled under vague headings like “taxes and license,” or “government fees.” The total looks plausible, so buyers sign without questioning it. Dealers may even train their staff to say, “That’s just what the DMV charges,” knowing full well it’s false.

This tactic is strategic, not accidental. It’s theft disguised as bureaucracy.

Why It’s Theft, Not a Mistake

Dealers might argue it was a one-time error, a misprint, or a misunderstanding. But when the pattern repeats — and it always favors the dealer — there’s no room for doubt. This is not negligence. It’s a scheme.

Overcharging the Vehicle License Fee is the same as charging you for taxes that weren’t owed, then pocketing the extra. It’s fraudulent and illegal. The DMV doesn’t authorize any dealership to estimate, adjust, or inflate this fee. They’re merely collectors.

Let’s be clear: when a business takes money under false pretenses, that’s not an accident. That’s a crime, especially when they don’t return the money after they “realize” you were overcharged.

In some cases, consumers have learned the overcharge wasn’t even forwarded to the DMV. It was treated as dealer revenue. This goes beyond unethical — it’s theft. And under California law, you can sue to get that money back.

California Laws That Protect You

When it comes to deceptive car dealership practices, California law is uncommonly strong in protecting consumer rights. Overcharging a government-mandated fee, like the Vehicle License Fee (VLF), falls under multiple legal statutes that empower you to seek justice.

First is the Consumer Legal Remedies Act (CLRA) under Civil Code §1770. This law prohibits a range of deceptive business practices, including the misrepresentation of the source or amount of fees in a transaction. If a dealer falsely claims a fee is fixed by the government — or inflates it without explanation — that’s a violation. The CLRA doesn’t just allow you to demand a refund. You can sue for damages, have your attorney’s fees paid, and even pursue punitive damages if the conduct was willful.

Then there’s Vehicle Code §11713(i), which directly governs car dealers. This section makes it illegal to make any untrue or misleading statements in connection with the sale or financing of a vehicle. That includes implying a fee is required by law when it’s not, or charging a higher amount than the DMV stipulates. This provision targets exactly the kind of behavior many dealers engage in when padding VLF charges.

Also at your disposal is Business and Professions Code §17200, known as the Unfair Competition Law (UCL). It prohibits “unlawful, unfair, or fraudulent business acts or practices.” This law is especially useful in cases involving widespread or systemic overcharges, because it allows both individual and class action lawsuits. If the practice has affected a large number of people, your case could be part of something bigger.